Trust Us To Lead The Way In Certification And Compliance

Knowledge And Expertise

Thorough Understanding Of The Framework, Its Requirements, And Best Practices For Implementation

Proven Track Record

Successful Track Record Of Helping Clients Achieve Compliance, With Positive Client Testimonials And Case Studies.

Strong Project Management Skills

Ensure The Compliance Engagement Runs Smoothly And Is Completed On Time And Within Budget.

Experienced Team

Possession Of Experienced Professionals, Including Auditors, Consultants, And Technical Experts

Exceptional Customer Service

Committed To Excellent Customer Service With Clear Communication, Responsive Support, And A Focus On Satisfaction.

Competitive Pricing

We Prioritize Delivering High-Quality Services With Competitive Pricing That Provides Exceptional Value To Our Clients

FAQs

FREQUENTLY ASKED QUESTIONS

PCI DSS Certification in

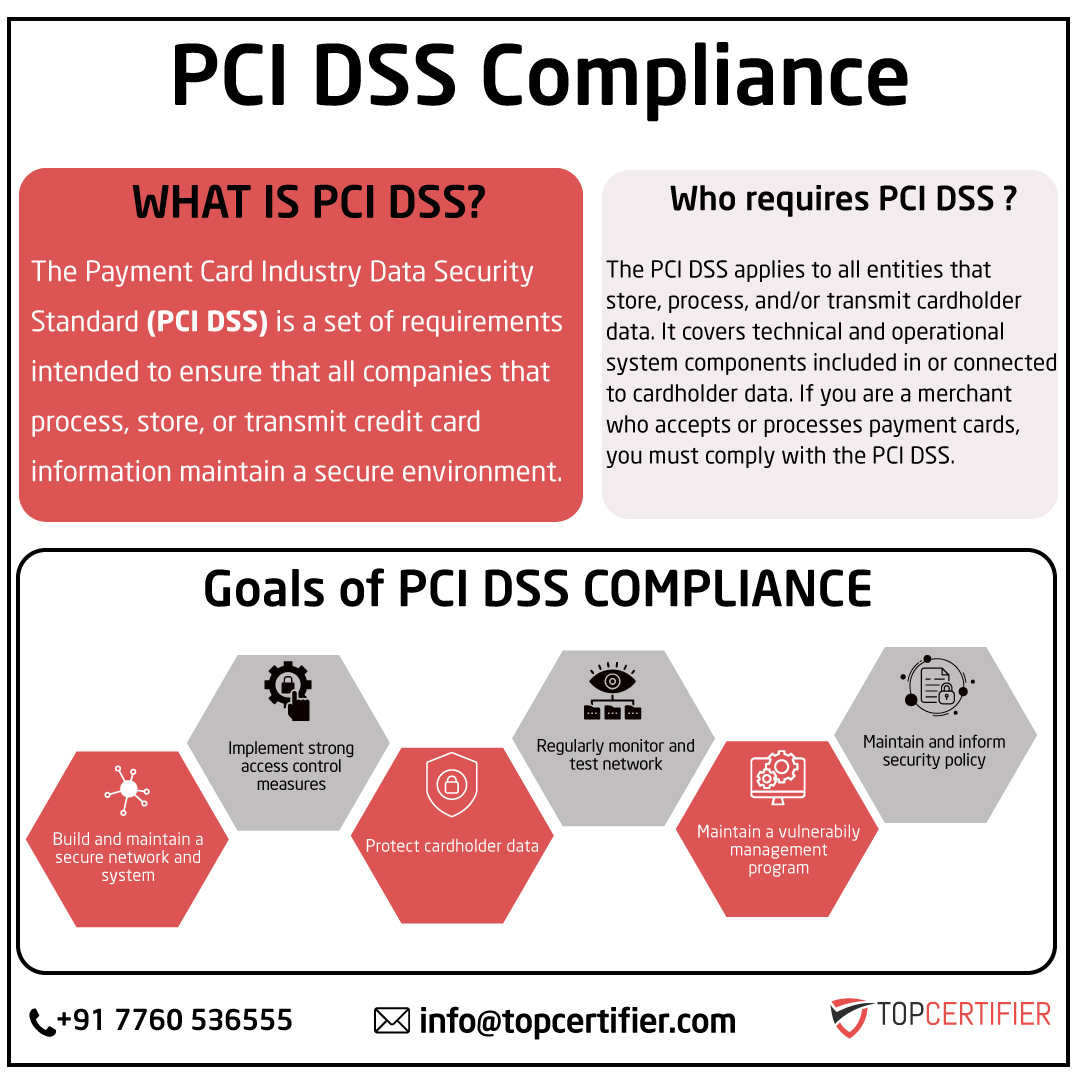

China is a globally recognized security standard designed to ensure that

organizations handling credit card transactions maintain a secure environment.

It defines a set of technical and operational requirements to protect cardholder

data and reduce the risk of payment fraud.

In China, PCI DSS compliance is critical for businesses such as e-commerce

companies, financial institutions, payment processors, and service providers. It

is governed by the Payment Card Industry Security Standards Council (PCI SSC)

and ensures that organizations adopt strong controls around data security,

network monitoring, and vulnerability management.

Any organization in China that stores, processes, or transmits payment cardholder data is required to comply with PCI DSS. This includes merchants, e-commerce platforms, banks, payment gateways, call centers, and third-party service providers.

PCI DSS has four compliance levels, determined by the volume of annual card

transactions:

Level 1: Over 6 million transactions annually (highest level of

compliance, requires an on-site audit).

Level 2: 1 million to 6 million transactions annually.

Level 3: 20,000 to 1 million e-commerce transactions annually.

Level 4: Fewer than 20,000 e-commerce transactions or up to 1 million

card transactions annually.

Each level has its own validation requirements, such as Self-Assessment

Questionnaires (SAQ) or audits by a Qualified Security Assessor (QSA).

While both PCI DSS and ISO 27001 focus on information security, they differ in

scope and objectives.

PCI DSS is specific to organizations that handle payment cardholder data

and is designed to protect against credit card fraud by enforcing strict

security controls.

ISO 27001 is a broader information security management system (ISMS)

standard that applies to any type of organization and covers all forms of

sensitive information, not just payment data.

Many companies in China pursue both PCI DSS and ISO 27001 to demonstrate a

strong commitment to data security and compliance.

To achieve PCI DSS Certification in China, an organization must:

• Identify the scope of cardholder data environment (CDE).

• Implement the 12 PCI DSS requirements, such as encryption, access control, and

network monitoring.

• Conduct a PCI DSS Gap Analysis and Remediation.

• Complete a Self-Assessment Questionnaire (SAQ) or undergo an on-site audit by

a Qualified Security Assessor (QSA).

• Submit a Report on Compliance (ROC) or Attestation of Compliance (AOC) as

applicable.

PCI DSS compliance is valid for 12 months and must be renewed annually. Organizations must continuously monitor their systems, conduct vulnerability scans, and ensure that all security controls remain effective to maintain certification.

Achieving PCI DSS Certification in China offers numerous benefits, including:

• Protection against credit card fraud and data breaches.

• Increased trust with banks, partners, and customers.

• Compliance with regulatory and contractual obligations.

• Stronger security posture and risk management.

• Competitive advantage in the global market.

The cost of PCI DSS Certification in China depends on factors such as business size, transaction volume, infrastructure complexity, and audit requirements. While costs may vary, the benefits of certification in terms of customer confidence and risk reduction far outweigh the investment.